The data format of the table to be filled in

Last updated November 6, 2024

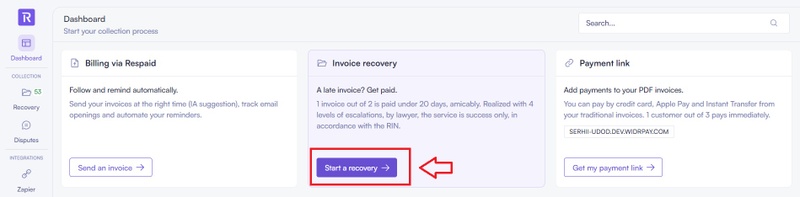

You can implement your receivables table from your interface by clicking "Start a recovery".

You will be redirected to our partner Stripe's website to provide the necessary information for fund transfers to your bank account.

Once this step is completed, you will have a form where you can download the export of the records in the required format to initiate the collection of receivables.

What are the necessary pieces of information to be submitted in the Excel spreadsheet?

Several pieces of information are crucial to initiate a case. Without these details, the case cannot be initiated.

Customer ID : Specific number assigned to the client by the principal → cus_81983992

Civil status of debtor → Mr. | Mrs.

Debtor Full Name* → Format: John Doe

Debtor Address in USA* → Format: 13 Howard Street Oswego NY 13126 USA, in a single row

Debtor Company Name (leave empty if an individual) → Format: UPPERCASE

Debtor's company DUNS number (optional) → Format: Numbers only, e.g., 123456897

Debtor's email* → Format: Email address without spaces or special characters, e.g., example@respaid.com

Debtor's mobile number* → International format preferred ( +33 6 12 34 56 78 )

Company issuing the invoice* (billing entity) → Format: UPPERCASE

Your Company's Address* (billing entity) → Format: 3014 R Street Northwest, Washington AR 20007

Invoice number linked to the outstanding balance* (separate multiple references with ",") → Format: Text

Issue date* (date of 1st invoice issued if multiple) → Format: "dd/mm/yyyy"

In the case of multiple invoices for a customer, having one line per customer is preferable to avoid sending multiple notifications per customer. Otherwise, the Respaid team will handle data merging.

Description of billed service* → Format: Text

Outstanding Balance * (for multiple invoices: total amount including tax) initial debt amount → Format: Number

Deposit * Advance Payments Made (if 0$: indicate 0) → Format: Number

Total Outstanding Balance * (automatic calculation of the difference between the initial debt amount and the deposit) → Format: Number

Once implemented, we will send an acknowledgment of receipt of the completed mandate with the table. By submitting a case, you will be asked to accept the terms of operation and the Terms and Conditions of Use (e.g., Data Storage, Billing Policy, Confidentiality Agreement, GDPR compliance, etc.).

Every case eligible for collection must compulsorily include the following information:

- debtor's identity,

- postal address,

- debt amount and down payments,

- invoice number and description, as well as

- contact information (email and mobile phone).

For any case that we manage to recover on your behalf, you can halt the proceedings from your Respaid interface.

The verification of the provided information and the file's compliance opens up the possibility to initiate the amicable recovery process within 3 working days.

To proceed with the collection or recovery process, it is necessary to ensure that the customer account created on the Respaid interface is configured with their banking information. This is to facilitate the transfer of funds to the creditor in the event of a successfully recovered debt.

On the day of initiation, an email will be sent to the creditor, informing them of the number of cases eligible for collection and providing the schedule of actions.

Respaid provides real-time updates to the creditor. A notification is sent via email, detailing the collection or recovery process. This notification is directed to the email address of the user who created the account and to any team members affiliated with the Respaid account.

The email notification specifies the payment arrangement (installment plan, full recovery, etc.), the amount, the debtor's identity, and the destination of the funds (to the creditor, to the lawyer, to the creditor via Respaid).

For this purpose:

-4 email reminders are scheduled. For a guaranteed outcome, we have established a dedicated notification schedule for debtors within the framework of amicable recovery. This strategy has proven to be highly effective in collections (achieving success rates of over 50% for certain debts).

-The sending of SMS and voice messages will depend on AI analysis of the debtor's behavior towards the notifications they have already received (timing, number of views, clicks on links, etc.). The messages are personalized based on your debtor's reactions, driven by AI, at the right timing, and through the appropriate channel. We also measure the satisfaction of your customers.

After initial internal processing within 20 days and multi-channel notifications, collection or recovery is entrusted to our network of partner lawyers, who take over by contacting debtors directly by phone.