What information is required to be in the Excel spreadsheet?

Last updated November 4, 2024

To initiate a collection and have the necessary information to transmit in the Excel table, you just need to follow the following steps:

1-Create an account on the Respaid platform .

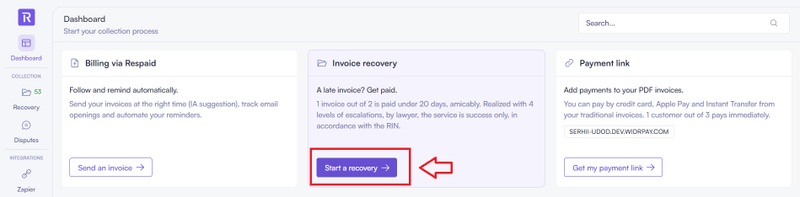

2-Then, once the account has been created and finalized, you can download here the template of the Excel table (containing all the necessary information) to recover and implement it properly filled from your Respaid interface by clicking on "Start a recovery".

(Required format: .xcel; .xls; .xltx)

Customer ID : Specific number assigned to the client by the principal → cus_81983992

Civil status of debtor → Mr. | Mrs.

Debtor Full Name* → Format: John Doe

Debtor Address in USA* → Format: 13 Howard Street Oswego NY 13126 USA, in a single row

Debtor Company Name (leave empty if an individual) → Format: UPPERCASE

Debtor's company DUNS number (optional) → Format: Numbers only, e.g., 123456897

Debtor's email* → Format: Email address without spaces or special characters, e.g., example@respaid.com

Debtor's mobile number* → International format preferred ( +33 6 12 34 56 78 )

Company issuing the invoice* (billing entity) → Format: UPPERCASE

Your Company's Address* (billing entity) → Format: 3014 R Street Northwest, Washington AR 20007

Invoice number linked to the outstanding balance* (separate multiple references with ",") → Format: Text

Issue date* (date of 1st invoice issued if multiple) → Format: "dd/mm/yyyy"

In the case of multiple invoices for a customer, having one line per customer is preferable to avoid sending multiple notifications per customer. Otherwise, the Respaid team will handle data merging.

Description of billed service* → Format: Text

Outstanding Balance * (for multiple invoices: total amount including tax) initial debt amount → Format: Number

Deposit * Advance Payments Made (if 0$: indicate 0) → Format: Number

Total Outstanding Balance * (automatic calculation of the difference between the initial debt amount and the deposit) → Format: Number

Note:

📌 To proceed with collection or recovery, we need to ensure that all information on the debtor, creditor and debt is complete. Fields marked with an asterisk (*) are mandatory.

📌 the seniority date must be less than two and a half years from the date of transmission of the file, beyond this limit, the application will not be considered.

📌Debtor with multiple invoices: when a debtor has several unpaid invoices, we've adopted a simple but effective method for organizing this information: a single line to represent each debtor, and separate the references of the different invoices with a comma (,).

For example, if a debtor has three unpaid invoices with references "FAC001", "FAC002" and "FAC003", you record this information in a single line dedicated to the debtor concerned. The dedicated column for invoices numbers will then contain "FAC001, FAC002, FAC003", clearly indicating the unpaid invoices associated with this debtor.

📌Why is it essential to adhere to the debt table format, and why can no internal modifications be made by the Respaid team?

When it comes to recovering unpaid debts, it is crucial to ensure the accuracy and integrity of information related to receivables. The standardized format of the receivables table is designed to ensure accurate and consistent transmission of information regarding the debts.

📌Avoiding risks of errors in the information:

The Respaid team specializes in debt collection or recovery and possesses considerable expertise in this field. However, we do not have in-depth knowledge of the individual debts held by each company. Each debt may have specific details and peculiarities that are known only to the company itself, such as exact amounts, applied interests, and more.

By requesting companies to make necessary adaptations themselves, we ensure that detailed and accurate information are correctly reflected in the the receivables table.

On the other hand, in order to enrich our customer experience, we invite you to answer a few questions during the insertion of the Excel file. This is to better respond to debtors. This step will only be necessary for your first file insertion.